Annuities

Most people want to live a very long life. However, longevity comes with risks, and it’s the biggest risk in retirement.

For example, the longer you live, the greater the chances of you needing expensive long-term care. And inflation can gradually eat away your retirement savings.

Your financial planning should account for these potential risks, and one way to do this is by purchasing an annuity.

What Is an Annuity?

An annuity is an insurance contract that allows you to turn part of your assets into profit that you cannot lose. It’s a different investment option that also lets you create a personalized income stream that lasts for life.

How it works is you transfer money to a provider that invests your cash according to your strategy and the type of annuity you select.

There are different types of annuities designed to meet different investment objectives. Whether your financial goals include fixed growth, Indexed growth, funding long-term care, wealth transfer, or something else, you can find an annuity that aligns with your intentions.

Annuities can provide security, knowing that you won’t outlive your assets.

Who Needs an Annuity?

Annuities aren’t just for retirees.

If you’re looking to diversify your investment portfolio pre and post retirement, you can benefit from an annuity.

FREE

no-obligation consultation.

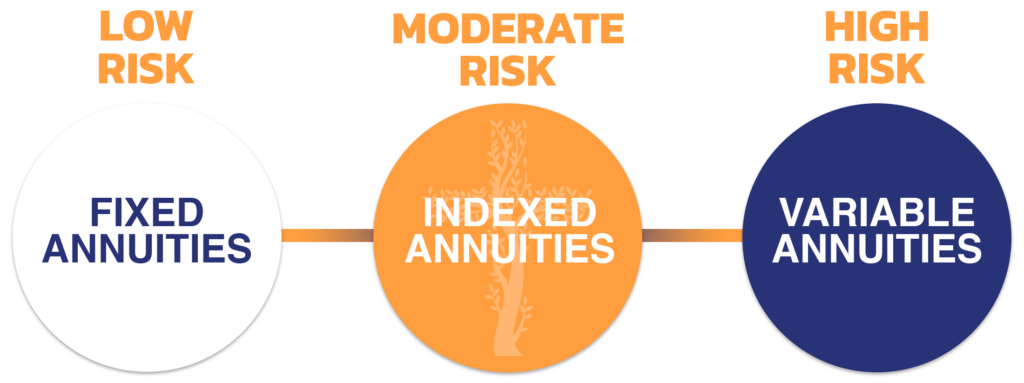

Types of Annuities

Fixed Annuities

Fixed annuities are the safest type of annuity because they pay at a set rate whether the market goes up or down. They’re a great option if you want modest growth and fairly predictable results. In some cases, you can defer income or withdraw it right away.

Variable Annuities

Variable annuities allow you to own mutual funds or investments inside the account. The account’s value is determined by performance, which means there is more risk involved AND the potential for greater returns if the market does well.

Fixed-Indexed Annuities

This type of annuity is often considered a win-win situation. It can offer a fixed rate of return (safety) and growth based on index performance (upside potential) — crediting interest and establishing a ceiling and floor to minimize risk. If you need guaranteed income or payouts based on long-term care, fixed-indexed annuities can cover things, and more.

Immediate Annuities

These are unique products because they provide you with a lump sum payment up front in exchange for routine payments until you pass away, or for a certain time. Since interest and principal amounts are included up front, the payments are typically higher than those required by other annuities.

Deferred Annuities

Deferred annuities promise to pay you, the owner, a regular income or a lump sum at a future date. They can help you build up your retirement savings and generate income when you get there. You can request payments from your deferred annuity at least one year after you opened it.

Consult with a Trusted Advisor

Some annuity contracts can be complex. Talk with Williams Financial Group to see if an annuity makes sense for you and your retirement goals.