Helping you find the Right Medicare plan that suits your needs

If you’re reading this, chances are you’re eligible for Medicare or you will be soon. Medicare can be confusing, but Williams Financial Group is here to answer questions and help you understand your choices — so you can make an informed decision on your healthcare coverage.

However, those are the only two parts administered by the government, and they don’t cover everything. Parts A and B cover approximately 80% of all approved charges. You’re responsible for the other 20%, and many people are unaware that there’s no maximum out-of-pocket limit on that 20%. The good news is that you have options, and that’s where Williams Financial Group comes in.

Who Is Eligible for Medicare?

You’re eligible when you turn 65, whether you’re taking Social Security income benefits or not. Some people are eligible before age 65 due to a disability or illness, like ESRD or ALS.

Original Medicare Doesn’t Cover Everything.

Without the Medicare program, healthcare would be quite expensive. Almost everyone gets Original Medicare because it covers the essentials: Part A is hospitalization coverage and Part B is medical coverage for doctor visits. Most folks get Part A premium-free because they paid Medicare taxes during their working years. Part B premiums are affordable.

Your Primary Coverage Options

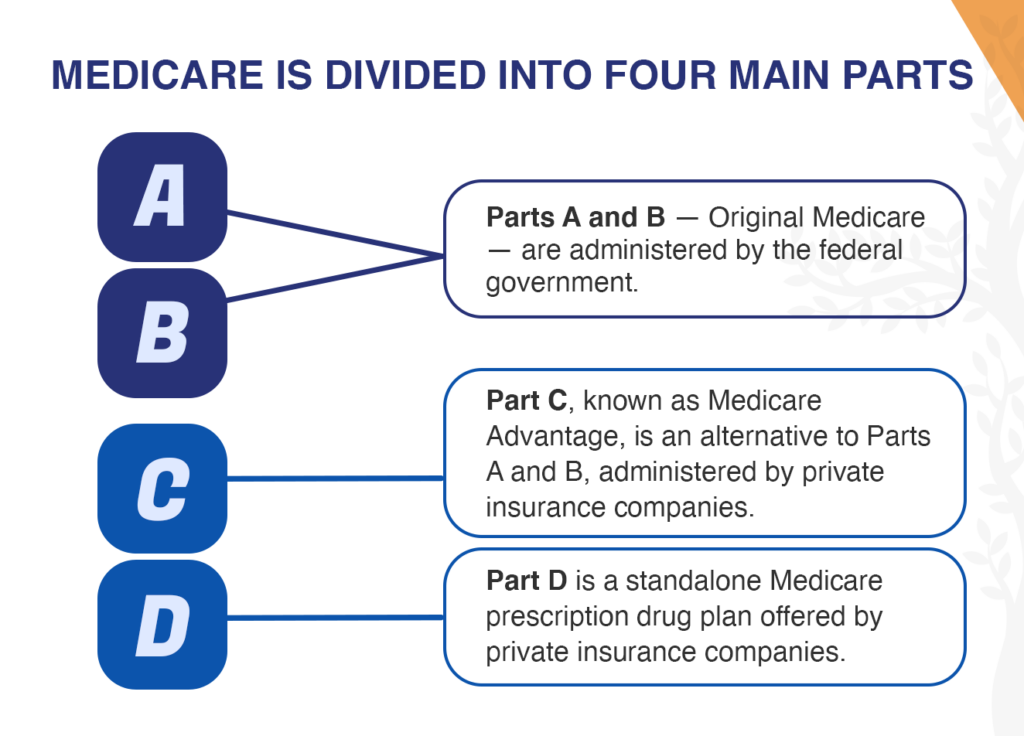

When you become eligible for Medicare health insurance, you can decide how to get your coverage. Your two main options are 1) Original Medicare, and you can add a Medicare Supplement and a stand-alone Part D plan, or 2) you can join a Medicare Advantage plan (more below). Medicare is divided into four parts, but you have two primary options for how to get your benefits.

Medicare Advantage Plans

Medicare Advantage, also known as Part C, is a group of Medicare health plans offered by private health companies. Medicare Advantage plans may offer important additional benefits such as dental, vision, hearing, and preventative services. These are things that Original Medicare doesn’t cover.

Many Advantage plans also include prescription drug coverage and charge low to no monthly premium. Williams Financial Group can help you determine if this option is right for you and help you take advantage of all the benefits available in your area based on your needs.

FREE

no-obligation consultation.

Medicare Supplement Plans

Many people sign up for Advantage Plans thinking they’re Supplements. The two are different. Medicare Supplement (Medigap) policies help pay some of the deductibles, copayments, and coinsurance that Original Medicare leaves behind. With a Medigap plan, you can go to any doctor or hospital in the United States that accepts Medicare patients.

We have access to many top-rated supplement insurance companies, and we can help you find the most suitable coverage — at the lowest rate — for your health needs!

Prescription Drug Plans

A separate Part D plan can help you manage the rising cost of prescription drugs. You can add one to your Original Medicare or use it along with a Medicare Supplement plan. Even if you’re not taking any medications in the beginning, we recommend signing up for a prescription drug plan to avoid a costly penalty in the future.

Since Medicare drug plans will change each year, you should do an annual review to make sure you’re in the right product for the right price.

When to Enroll in Medicare

For most, the best time to enroll is during the Initial Enrollment Period. This is a 7-month period surrounding the months of your 65th birthday. However, there are some exceptions for Medicare enrollment.

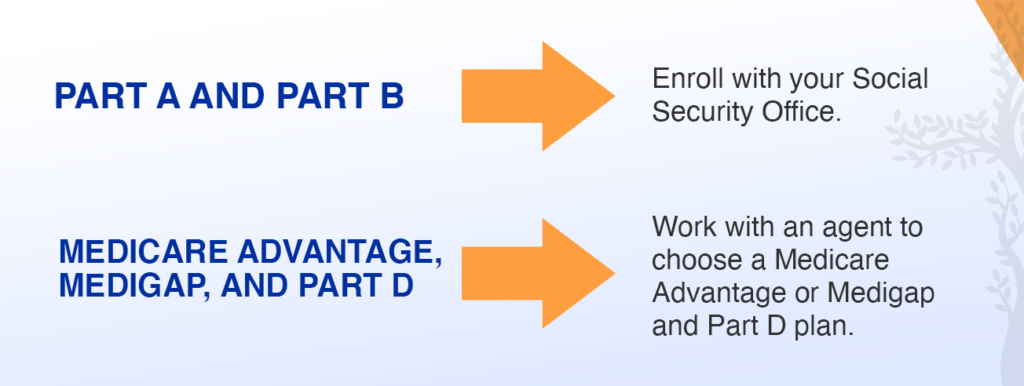

If you’re already taking Social Security benefits, you’ll be automatically enrolled in Parts A and B. If you decide not to enroll in Part B when you’re first eligible, you may face a late enrollment penalty.

Those who haven’t signed up for Social Security and are no longer working can visit www.ssa.gov to find out how to enroll in Medicare. Do this before you turn 65.

Already Have Medicare?

Your first choices are not etched in stone. Medicare recipients can make changes to their current coverage during the Annual Enrollment Period, which begins on October 15 and ends on December 7. If you make changes during this time, your new coverage will kick in on January 1.

Book a Consultation With Us.

Williams Financial Group is here to guide you through the complicated maze of Medicare. Whether you’re enrolling for the first time or thinking about making changes to your plan, we can help. So, schedule your FREE consultation today!